| Competing place of energy storage industry: energy storage system integration (E |

| Release time:2022-12-08 09:19:20| Viewed: |

Competing place of energy storage industry: energy storage system integration (ESS)

Under the background of "double carbon", the energy storage industry is on the market.

With the explosion of global energy storage market demand, new and old players quickly launched a new round of layout in the industrial chain link.As the midstream link of the energy storage industry chain, the system integrator is responsible for the equipment provider and the owner of the energy storage system, which has become a competitive place in the energy storage industry. In 2022, the global energy storage market will continue the high-speed growth trend of 2021, and major markets such as Europe, America and China will blossom in many places, driving the scale of energy storage system integration orders to rise rapidly year-on-year. " According to the survey of relevant data, the orders of domestic leading system integrators increased by 1 to 10 times year on year, and the order production schedule has reached Q1 in 2023.

Basic concept of system integration ESS Electric energy storage system integration (ESS) is a multi-dimensional integration of various energy storage components to form a system that can store electric energy and supply power. Components include converter, battery cluster, battery control cabinet, local controller, temperature control system and fire protection system.

System integration ESS function

1) Smooth transition: it can smooth the output of solar and wind power generation and reduce the impact of randomness, intermittency and fluctuation on the power grid and users; 2) Peak cutting and valley filling: through charging in the valley price period, discharge in the peak price period can reduce the user's electricity expense;

3) Frequency and voltage regulation: When the large power grid is powered off, it can operate in isolated islands to ensure uninterrupted power supply to users and operation of the micro grid.

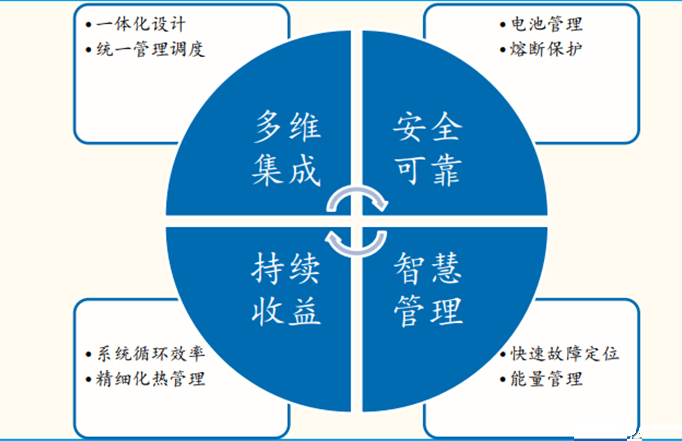

Classification of key technologies of energy storage system

1. Multidimensional integration: front-line scheduling control, including unifying the front and rear interfaces, ensuring the compatibility of all parts, etc.

2. Safe and reliable: battery systematic management, system charging and discharging linkage, fire fighting, etc.

3. Continuous benefits: intelligent temperature control, efficient charging and discharging cycle, thermal management, etc

4. Intelligent management: intelligent monitoring, communication control, etc

Integration technology builds up barriers to system integration industry. The energy storage system integration needs to include multiple system integration control technologies such as thermal management and protection. It needs to fully understand the performance of the battery, converter and other components to maximize the potential of the battery. It also needs to take into account the safety, fire protection and other issues as a whole. It requires strict systematic thinking of the entire energy storage system.

Key technologies of integrated energy storage system

Development and bottleneck

1. High technical requirements: system integration requires a deep understanding of the energy storage system and industry application scenarios. It is difficult to achieve cross application scenario order taking due to insufficient technical strength. High technical requirements bring high R&D and operation costs;

? Customized demand: at present, the industry is mostly project oriented non-standard orders, which is difficult to form scale effect;

? Large uncertainty of downstream payment capacity: at present, the scale of domestic energy storage system integration services is limited, and the downstream payment capacity fluctuates greatly.

2. Technology integration or becoming the main development direction of system integrators.

Among the system integration enterprises with the highest shipping volume, in addition to mastering the system integration (ESS) technology, they also master the upstream technologies such as EMS and BMS, and build their core competitiveness by building a technology chain that runs through the entire energy storage industry.

? The shipment volume of Sungrow Power is far ahead among system integrators, but most of them are concentrated in overseas markets.

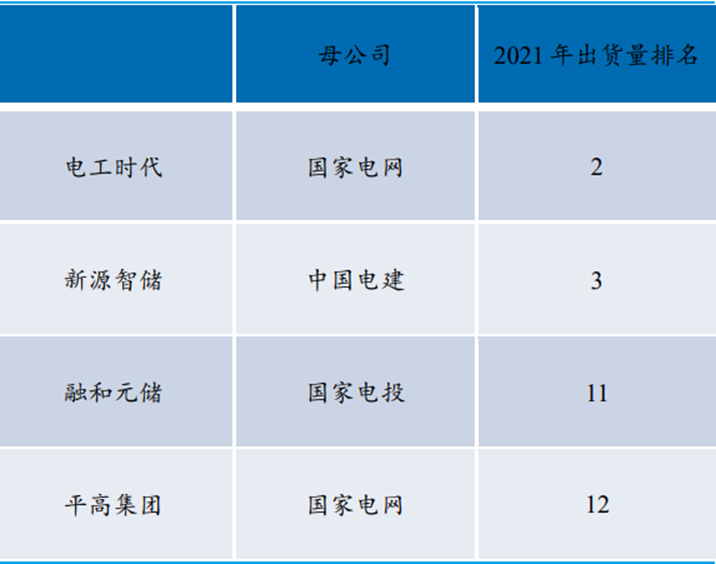

? At present, the domestic market is still dominated by energy storage technology service franchises such as Hibiscus, Electrician Times, etc., but there is no obvious differentiation in the domestic market between manufacturers' shipments. Some system integration service providers rely on large power groups such as PowerChina and the State Grid, with strong R&D and operating fund guarantees and relatively stable downstream demand.

List of state-owned enterprises of major system integrators

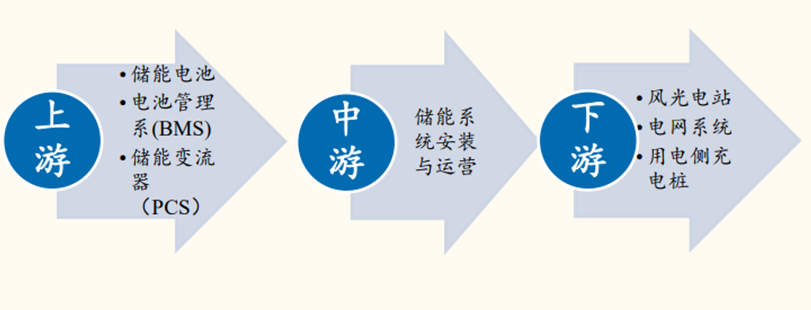

Industrial chain

The system integration industry chain includes upstream energy storage battery, battery management system BMS, energy storage converter PCS and other parts; Installation and operation of midstream energy storage system; Downstream new energy wind power station, power grid system, user side charging pile, etc.

The fluctuation of upstream supply does not constitute a major impact, and system integrators mostly rely on downstream project demand to carry out customized services. The system integration end has lower requirements for upstream battery indicators compared with new energy, so there is more room for suppliers to choose, and it is rare to bind with fixed upstream suppliers for a long time.

Overview of energy storage system integration ESS industry chain

Schematic diagram of ESS integrated system

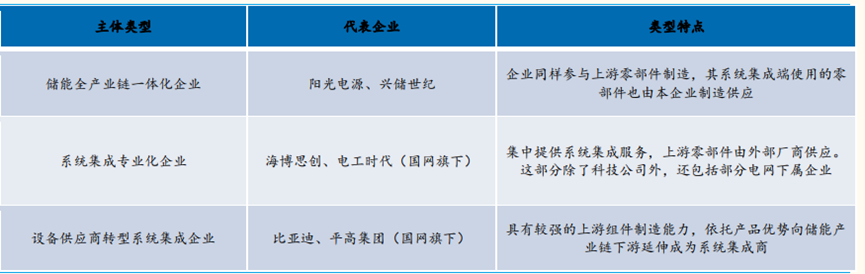

Classification of main system integration participants 1) Energy storage industry chain integration enterprise. Such enterprises also participate in the manufacturing of upstream energy storage parts, and the parts used in the system integration end are also manufactured and supplied by their own enterprises. (Representative enterprises: Sungrow Power, Xingchu Century, etc.)

2) Specialized enterprise of system integration. Such enterprises provide system integration services centrally, and upstream parts are supplied by external manufacturers. In addition to science and technology companies, this part also includes some subordinate enterprises of the power grid (representative enterprises: Hibo Innovation, Electrician Times, Xinyuan Intelligent Storage, Kehua Digital Energy, Lin Yang Yiwei, Cairi Energy, etc.)

3) Equipment suppliers transform into system integration enterprises. Such enterprises have strong upstream component manufacturing capacity, and rely on their own product advantages to extend to the downstream of the industrial chain to become a manufacturer of "parts+energy storage system integration". (Representative enterprises: BYD, Pinggao Group, Zhongtian Technology, etc.)

Classification of system integrator (ESS) manufacturers

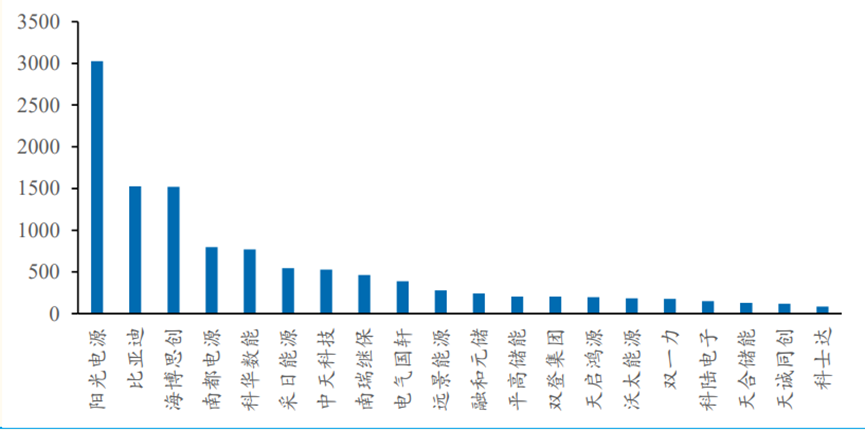

The market layout strategies of system integration enterprises are different. In general, the top five enterprises in the market share are: Sungrow Energy, BYD, Hibiscus, Nandu Power and Kehua Sungrow, all of which are private enterprises.

? Sunshine Power Supply and BYD have more overseas markets.

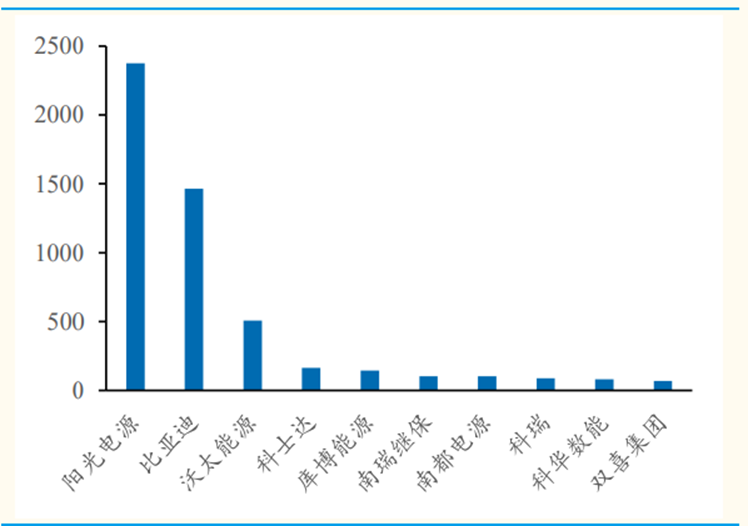

According to the 2022 White Paper on Energy Storage Industry by CNES, the top three outbound shipments of system integrators are: Sungrow Power, BYD and Wotai Energy. According to the 2021 annual report of Sungrow Energy, the company's annual energy storage system shipments reached 3000 MWh. However, due to the fierce market competition, the overseas market share of domestic system integrators is low, only 5% - 10%.

? The domestic market is still in its infancy, with a small overall scale and low market concentration.

According to the shipment volume of the energy storage system, the system integrators ranked among the top three in the domestic market: Hibiscus, Electrician Times, and Xinyuan Intelligent Storage. The domestic shipment volume of Hibiscus is less than 800MWh, and the shipment volume of the other top ten manufacturers is about 400-800MWh, which is expected to expand with the further development of the energy storage industry in the future.

Shipments of energy storage systems in overseas markets by energy storage system integrators in 2021 (Mwh)

Shipments of energy storage system in domestic market by energy storage system integrator in 2021 (Mwh)

|