| Another "shoulder" of new energy storage! |

| Release time:2022-12-26 15:13:09| Viewed: |

Another "shoulder" of new energy storage!

In the past, when the power grid did not cover every corner of the country as it does now, every household in farming and pastoral areas would choose to install a small fan or a photovoltaic panel to meet the power demand.

When the wind is getting stronger and the fan is creaking, it is probably the happiest time for the local children, which means they can sit in front of the TV again and watch a favorite cartoon with satisfaction.

However, there is no rule to follow when the wind comes and goes. When there is no wind, the household appliances will face the dilemma of no electricity available.

In order to smooth the uncertainty of wind power generation, each household will also configure a large battery for the wind turbine. When the wind is strong, this battery can store the power generated more, so as to achieve the power demand when there is no wind.

Of course, households that install photovoltaic will also encounter similar problems, so they will also be equipped with corresponding batteries to store electric energy during the day and then discharge at night.

Through this combination, countless families in farming and pastoral areas enjoyed the light at night, and countless children had a childhood with deep memories.

With the substantial increase of power grid coverage, few households need to consider power supply at present, and the combination of household fan/photovoltaic+battery would have faded out of people's vision. Now, with the advent of carbon neutrality, this combination is becoming an indispensable part of the national power system.

01 Why is energy storage required?

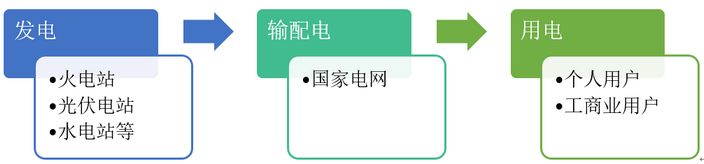

China has a huge and complex power system, which is mainly composed of power generation, power transmission and distribution, and power consumption. On the power generation side, all kinds of power stations first sell electricity to the national grid; On the power transmission and distribution side, the State Grid transmits and distributes power to various users at the terminal.

Composition of China's power system, source: 36 krypton Electric energy has a very obvious feature, that is, it cannot be directly stored, that is, how much electricity is generated, how much electricity is used.

From the perspective of total amount, power generation and power consumption need to be consistent; From the instantaneous point of view, power generation and power consumption need to maintain a dynamic balance.

As the intermediary between the power generation side and the power consumption side, the State Grid has always been responsible for maintaining the balance between power generation and power consumption. In the era of thermal power generation, various regulatory measures implemented by the State Grid can barely meet the balance of power supply and demand.

For example, the power from a certain region can be transmitted to the power shortage region through power grid dispatching; For example, different electricity prices can be set for peak and low periods of electricity consumption to stabilize demand; However, at the power generation end, the power of the generator set can be controlled to match the power demand in different periods of time to meet the requirements of peak shaving and frequency modulation.

That is to say, although the power demand is unstable, the power supply of thermal power plants is stable and controllable. The State Grid can take the regulation of power supply as the final regulation means at the supply side to match the power change at the demand side, so as to maintain the balance of power supply and demand.

However, under the wave of carbon neutralization, the increasing proportion of green electricity is making the power supply gradually out of control.

In 2021, China's wind power and photovoltaic power generation will account for about 11% of the total social electricity consumption. According to the prediction of the National Development and Reform Commission, the proportion of photovoltaic power generation alone will reach about 39% by 2050.

To take an extreme example, if the power structure of the country is dominated by photovoltaic power generation, the output (output power) of photovoltaic power stations will be in an unstable state due to the uncontrollable changes in local climate conditions. In this case, the power grid cannot control the amount of photovoltaic power generation to match the electricity demand at that time, just as it can control thermal power units. In addition, when night comes and photovoltaic power stations stop generating electricity, the whole country will face the dilemma of no electricity available.

At this time, the emergence of energy storage is natural and inevitable.

Through the energy storage system, power can be "digested" and stored at the peak of green power generation, and at the same time, electricity can be released to meet the electricity demand at the time of low power generation. That is to say, the energy storage system essentially plays a role in stabilizing and regulating green electricity on the supply side.

As mentioned at the beginning of the article, farmers must be equipped with batteries when installing wind turbines or photovoltaic. When the power structure of the whole country starts to tilt to green electricity, the demand for energy storage systems is becoming increasingly urgent.

When photovoltaic, wind power and other projects are in full swing, national policies related to energy storage are also being intensively announced.

From the perspective of policy orientation, at present, China's new energy storage projects (such as batteries, hydrogen energy storage, etc.) are still in the early stage of commercialization. In 2025, energy storage will change from the early stage of commercialization to large-scale development, until 2030, energy storage will achieve full market development. It is not difficult to see that it will be a long-term process from the initial stage of commercialization to the full marketization of energy storage, and it will not be achieved overnight.

Energy storage target planning, data source: 36 krypton

Summary of policies related to energy storage, source: NDRC, 36 krypton 02 Why has battery energy storage become the "star" of the industry?

According to the classification of technical paths, energy storage systems are mainly divided into chemical energy storage and physical energy storage.

Among them, chemical energy storage "consumes" electric energy and stores it by converting electric energy into chemical energy. The mainstream technology path includes battery energy storage and hydrogen energy storage. At present, lithium battery, sodium battery and vanadium battery, which are hot in the capital market, are the representative works of chemical energy storage.

Physical energy storage mainly includes flywheel energy storage, capacitor energy storage, and the well-known "older generation energy storage" pumped storage. The working principle of flywheel energy storage is that under the condition of abundant electricity, the flywheel is driven by electric energy to rotate at high speed, and the electric energy is transformed into mechanical energy storage, but the energy storage time is short. Pumped storage is to use electric energy to pump water to a high place and convert electric energy into gravitational potential energy for storage.

According to the function classification of energy storage system, it is mainly divided into power energy storage and capacity energy storage. The power type energy storage mainly maintains the power balance of the power system at the time point through the instantaneous charging and discharging, while the capacity energy storage is mainly used to smooth the peak valley power demand.

From the perspective of popularity, battery energy storage is undoubtedly the "hot cake" in the market, while from the perspective of market share, the current winner is pumped storage.

According to the statistics of China Merchants Bank, as of 2020, the cumulative installed capacity of the energy storage projects that have been put into operation in China is 35.6GW, of which pumped storage occupies the absolute leading position, reaching 31.79GW. The scale of electrochemical energy storage in the new energy storage technology ranks second, 3.3GW. Among the electrochemical energy storage technologies, the scale of lithium ion battery is the largest, with a cumulative scale of 2.9GW.

It is not difficult to find that the most "tall" electromagnetic energy storage and hydrogen energy storage are unknown in practical applications.

This is because the green power industry is always controlled by an invisible big hand, that is, cost control. Only when the overall cost and price of the green power industry become the absolute advantage of thermal power, can it be effectively accepted by the electricity market, so as to achieve carbon neutrality more quickly.

Therefore, cost is the most priority factor in the green power industry, and technological progress is also to reduce costs. As an important part of green power, energy storage is no exception.

To measure the cost of energy storage system, the market often uses the indicator of life cycle cost of electricity (LOCE). To put it simply, it is obtained by discounting all the expenditures (including purchase expenditures, operation and maintenance expenditures, etc.) incurred by the energy storage system in its life cycle and dividing them by the cumulative electricity discharge in its life cycle.

According to the calculation of Yingda Securities, the electricity cost per kilowatt hour of pumped storage is about 0.23 - 0.34 yuan/kWh, and the battery energy storage is about 0.67 yuan/kWh (sodium battery/vanadium battery is expected to reach 0.27/0.44 yuan as a minimum in the future). In the current application scenario, the cost per kilowatt hour of hydrogen energy storage is more than 1 yuan, and the electromagnetic energy storage has not yet fully met the conditions for commercial application.

It is obvious that pumped storage has the most leading cost advantage, so it also has the largest market share.

So, why has battery energy storage become the "hot cake" of the capital market?

One important reason is that, due to the limitation of geographical environment, the growth space of pumped storage has a ceiling, which cannot meet the huge demand for energy storage in the long run. Another important reason is that pumped storage is mainly used for capacity energy storage, which is still lacking in power energy storage, while battery energy storage has good performance in capacity energy storage and power energy storage.

In addition, from the perspective of initial investment cost (purchase expenditure), the initial investment cost of building a pumped storage power station is often hundreds of millions or even billions, while battery energy storage can be flexibly arranged according to demand, and can also attract more social capital to participate.

Therefore, the application scenario is more flexible, and the cost per kilowatt hour is second only to the battery energy storage of pumped storage, which will become the main force of energy storage in the future. Of course, pumped storage will still play an important role in the energy storage market in the short term.

03 Commercialization dilemma under "rigid demand"

The long-term space for energy storage is certain, but the short-term start is difficult. As a just needed supporting facility for green electricity, energy storage is currently mainly a cost project rather than a non-profit project.

In China's power system, although energy storage can flexibly participate in all aspects from the generation side to the user side, the willingness of capital mobilization is not strong.

For the power generation side, China requires wind power and photovoltaic projects to configure a certain proportion of energy storage systems according to the installed capacity, which is the main demand source of the energy storage market at present.

With the increasing allocation ratio, the cost pressure of the power station is becoming heavier and heavier. The transmission of cost pressure to the downstream will also discourage consumers from using green electricity.

According to the calculation of Tianfeng Securities, if a photovoltaic power station with an average daily effective power generation time of 3.8h is configured with a 2-hour energy storage project (equivalent to 5% of the total power generation of the power station) based on the conventional 10% installed capacity ratio, then the cost of energy storage will be allocated to each kilowatt hour of electricity generated by the photovoltaic power station, which will increase the cost of photovoltaic power per kilowatt hour by 0.03 yuan (about 10% cost increase). In 2022, the allocation and storage ratio of power station projects in Zaozhuang, Shandong Province, will even reach 30%, with the maximum allocation and storage time up to 4 hours.

For the power grid and the user side, the social capital can voluntarily purchase the battery energy storage system, obtain compensation income by participating in peak regulation and frequency modulation in the power market, or arbitrage the peak valley difference.

However, at present, the profit model has not been fully realized.

In terms of cost, according to the above data, the life cycle kilowatt hour cost of independent energy storage is about 0.67 yuan/kWh. If the project is to be profitable, the compensation for the participation of the independent energy storage project in peak shaving and the difference between peak and valley electricity prices will exceed the cost of electricity per kilowatt hour.

In terms of income, according to the calculation of Tianfeng Securities, at present, only Guangdong and Tianjin have a peak shaving compensation of more than 0.67 yuan, which means that in most provinces, the income from independent energy storage participating in peak shaving is not enough to cover the cost. In terms of peak valley electricity difference arbitrage, only a few regions such as Beijing can realize project profits.

In order to guide social capital to voluntarily participate in the energy storage market on the power grid and the user side, and reduce the pressure on distribution and storage on the power generation side, it is necessary to make social capital "profitable". That is to say, energy storage projects can be more widely used on the grid side and the user side only if they are commercialized.

Peak shaving compensation price of each province, source: Tianfeng Securities, 36 krypton 04 The policy continues to increase

For the current dilemma of independent energy storage participating in the power market, various regions have also started to actively carry out policy support, such as increasing the peak shaving compensation price and the peak valley price difference.

For example, on May 4, 2022, the National Development and Reform Commission pointed out in the Notice on Further Promoting the Participation of New Energy Storage in the Power Market and Dispatching Application that, if an independent energy storage power station transmits power to the grid, its corresponding charging power will not bear the transmission and distribution price, government funds and surcharges.

In the past, when independent energy storage participated in the power market through the peak valley price difference, its power purchase price from the grid was mainly composed of on grid price+transmission and distribution price+government funds and surcharges.

According to the statistics of Zhongtai Securities, the power transmission and distribution price, government funds and surcharges together account for more than 30% of the power purchase price. Taking Jiangsu Province as an example, the grid price, power transmission and distribution price, government funds and surcharges are 0.4594, 0.2110 and 0.0294 yuan/kWh respectively, and the power transmission and distribution price and government funds account for 34.35% of the electricity price.

If the electricity transmission and distribution price, government funds and surcharges are not borne when purchasing electricity for energy storage, this provision will significantly reduce the cost of energy storage and charging, and increase the peak and valley price differential income.

Composition of independent energy storage purchase price, data source: 36 krypton

Composition of purchase price for ordinary users, data source: 36 krypton

In addition, according to the compensation fees for peak shaving announced by various regions, the overall trend is also on the rise. For example, the peak shaving compensation in Guangdong, Guangxi and other places in the southern region in 2022 has been significantly higher than that in 2020. The above two measures will significantly increase the income of social capital participating in independent energy storage, thereby promoting the development of Chu energy storage market.

Compensation standard change of deep peak shaving in the south region, data source: 36 krypton 05 How big is the energy storage space

However, the secondary market is not very worried about the process of energy storage commercialization.

Investors have already begun to bet on the bright future of energy storage. Whether it is the hot sodium battery last year or the new vanadium battery and gravity energy storage this year, relevant concept stocks have been popular in the capital market.

So, how big is the space for energy storage?

According to the calculation of Tianfeng Securities, the scale of energy storage market in the next few years will still be mainly contributed by the forced allocation and storage on the generation side. It is estimated that the installed capacity of domestic power generation side energy storage is expected to reach 4.7/14.3/25.2/42.4/68.4GWh in 21-25, with a compound growth rate of 95% in four years.

Calculation of installed capacity of energy storage at domestic power generation side, data source: Tianfeng Securities, 36 krypton

On the grid side, it is estimated that the demand for independent energy storage on the grid side will reach 1.2/3.5/6.3/9.8/13.8GWh from 2021-2025, with a compound growth rate of about 85%.

Prediction of installed capacity of independent energy storage on domestic grid side That is to say, in 2025, the domestic demand for installed energy storage at the grid side and only at the grid side will reach 80GWh. However, compared with the installed capacity of new energy vehicle power batteries, energy storage is still small. According to the prediction of China Automobile Association, the domestic power battery shipment will reach 500GWh in 2025.

However, according to the policy planning, 2025 is only the starting point for the large-scale development of energy storage. According to the prediction of Haitong Securities, with the continuous increase of the proportion of clean energy in the energy system, such as Global Scenery, the market scale of energy storage in the future will probably exceed that of power batteries, reaching 1000-2000GWh.

Under the deterministic and long-term growth of the energy storage market, as previously analyzed, battery energy storage, as the most flexible and affordable energy storage mode at present, will gradually take over the role of "pumped storage" and become the main force of the energy storage market with the support of policies.

So, which industries will benefit from this?

From the specific composition of the battery energy storage system, it mainly includes battery, battery management system (BMS), converter (PCS), energy management system (EMS), cabinet cable and civil installation.

Among them, the battery accounts for about 60% of the initial investment cost, the converter accounts for about 20%, and BMS and EMS account for about 15% in total. The link with the highest investment cost of the energy storage system is also the link with the highest value, so the enterprises related to batteries, converters, BMS and EMS will benefit first.

Structure and cost composition of energy storage system

Among them, the battery part of the energy storage system is essentially similar to the battery used in new energy vehicles. For example, the power battery and energy storage battery currently use lithium iron phosphate as the main cathode material, and the technology is relatively mature. Therefore, the main participants in the energy storage battery industry chain are still a group of power battery manufacturers such as Ningde Times.

However, in the context of the soaring price of lithium iron phosphate, other energy storage battery manufacturers were forced to start looking for alternatives.

For example, the first generation sodium ion battery led by Ningde Times last year and the vanadium battery in the recent capital market fire are the compromise options under the soaring price of lithium iron phosphate.

From the perspective of the maturity of the industrial chain, lithium batteries have been recognized by the market in the field of power batteries, and a complete industrial chain has been formed. However, sodium batteries and vanadium batteries are still insufficient compared with lithium batteries in terms of the maturity of the industrial chain and energy density.

However, sodium battery and vanadium battery have a clear expectation of cost reduction after the maturity of the industrial chain. Yingda Securities estimates that the cost per kilowatt hour (LOCE) of sodium battery/vanadium battery in the future is expected to drop as low as 0.27/0.44 yuan, which will form a significant cost advantage for lithium battery. Therefore, new entrants in relevant fields will also benefit from the wave of energy storage construction.

Comparison of electrochemical energy storage technology routes |